The battle for new customers

What sport rights holders and media companies could learn from the music industry

For several decades Live Sport has been one of the most valuable assets of the media industry. In the past the growth of traditional Pay TV without live sport content seemed hardly feasible. However, in an ever more fragmented sport media market with ever-growing sports content offerings, players will come under pressure.

Digitalization, the price increase of major sport media rights, streaming players with new, (underrepresented) live sport offerings, change in user behavior of generation Y/Z, new disciplines like e-sports and gaming needs to be considered to keep or build a reliable mid/long term business model.

As it happened in other media segments already it is very likely that the digitalization in the sports media world and the related changes such as increased content diversity and provider fragmentation lead to a balance of power shift from provider towards consumer.

Since budget and time of consumers over all media channels are limited, it is therefore helpful, market players recall what happened during the digitalization process in other media businesses.

A look into the music industry

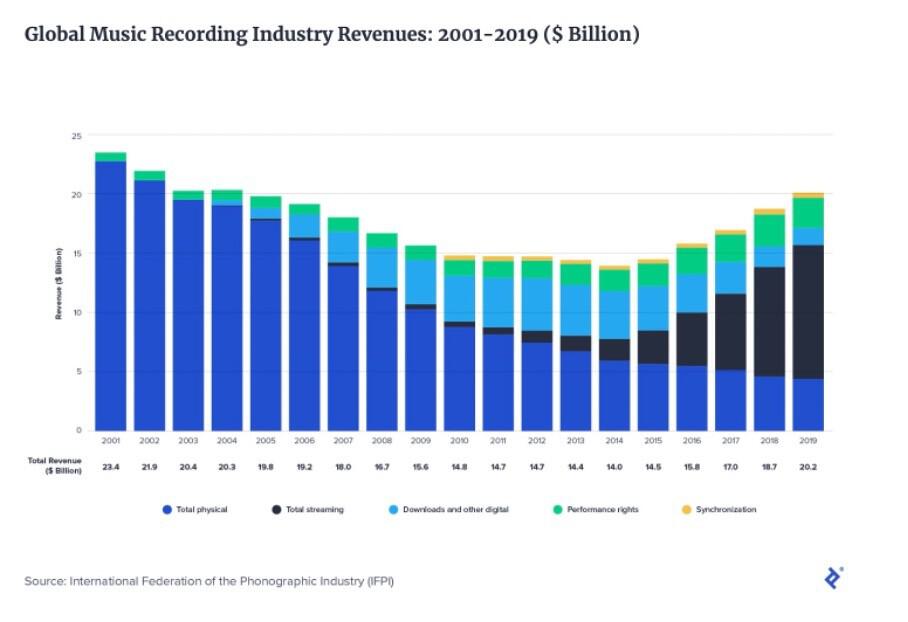

One of the best examples of a disruptive market change can be found in the music industry. Around millennium the traditional business models of the music industry were attacked by digitalization. After a shock phase where labels tried to hold on to traditional business models it was time for a totally new approach. Which was first selling mp3´s and later music streaming as we know it today.

Even if you can´t compare apple with oranges it’s may worth considering how the music industry and its new players used the digitalization benefits to build a profitable new growth strategy.

Along with the over years decline of the music industry where piracy and digital exchange of music content heavily attacked the business new players established a whole new market: music streaming Later this business model has been successful adapted by video streaming services such as Netflix, Amazon Prime, Apple, Disney Plus, etc..

When “free” turns into “paid”

The commercial market success of these new service was mainly driven by offering new customers a basic user experience almost free of charge.

Spotify and other companies established the so called “Freemium” business model within the media world. The model which has been in use for software sales since the 1980s, offers a time-limited or feature-limited version of the service to promote a paid-for full version.

The idea behind is (as Wikipedia explains):

Give your service away for free, possibly ad supported but maybe not, acquire a lot of customers very efficiently through word of mouth, referral networks, organic search marketing, etc., then offer premium priced value-added services or an enhanced version of your service to your customer base.

Today the “Freemium” model is used in many other media businesses. In particular where the digitalization process has attacked the traditional business model. The print media industry is an additional example where almost all players use a “kind of” “Freemium” to attract customers for their service. (e.g. Spiegel / Zeit in Germany)

Furthermore, the success of the gaming industry and a lot of apps is closely linked with the benefits “Freemium” has offered.

Freemium for sport streaming

For whatever reason, this tool to engage customers is not yet wildly spread in the sport streaming market. But there are several examples where some players are attempting carefully first steps. Rights Holders who use “YouTube” for distributing free content set the first indications of an attempt to attract potential customers outside the own business environment. Although, the benefits of converting a free customer into a paid customer on external platforms is rather difficult.

A good example in Germany is one of Sport.Media.Net customers Magenta Sport. Deutsche Telekom offers exclusive packages for mobile and fixed line customers where a free subscription for almost 12 Month is included.

Also, the Magenta Sport platform offers a so called “preview-portal”. It works as a “store window” where the user gets an idea of what is behind the door. He is able to get a glimpse of the included content and is even allowed to watch some live events free of charge and without creating an account.

Another approach is a free of charge trial for a first time user. DAZN seems to have made good experience with this strategy as they offer a 30 day test phase since the start of the service.

What is the conclusion?

It is nearly unthinkable that the sport streaming market will be disrupted by the digitalization as hard it has happened to other media segments.

However even if the business model for sport streaming seems to work pretty fine for the moment, it could not harm to take a look at successful freemium models and adapt the business accordingly to start building a larger customer base.

Giving customers a real platform experience is certainly one of the best ways to attract their interest.